Tax Client Letter Example

This site uses cookies to store information on your computer. The letter should state the following Example is for 2008.

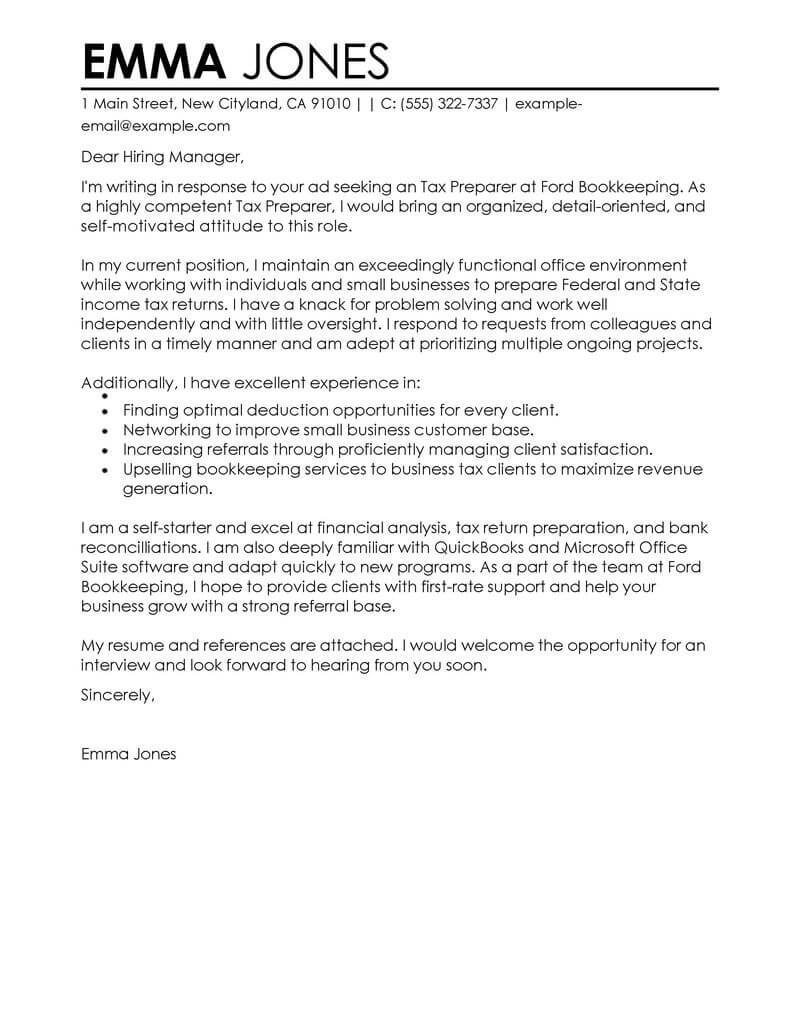

Tax Preparer Cover Letter Examples Finance Livecareer

The letter attests to the accuracy of the financial statements that the company has submitted to the auditors for their analysis.

. Give below is a sample letter format for changing email and mobile number in income. We saved one client over 30000 using this method. Others help us improve the user experience.

Capitalize T for Taxpayer when referring to the client cite authority according to the Bluebook and use lowercase s for section unless it starts a sentence. Enclosed with this letter is the final distribution to you from the Trust. Management representation is a letter issued by a client to the auditor in writing as part of audit evidences.

Im writing to notify you that weve yet to receive payment on invoice invoice number for the amount of invoice amount which was due due date. Heres a quick example. A few style tips.

If you think you could benefit from the help of a tax attorney schedule a consultation. You can use a sequence of numbers that gradually increases. A control objective provides a specific target against which to evaluate the effectiveness of controls.

Engagement letters are traditionally used by certain professional service firms. An overdue invoice letter in this case will serve to notify the client that you will turn over their account to a collection agency in a certain number of days if you dont receive. An engagement letter is a written agreement to perform services in exchange for compensation.

Michael Smith will leave Malaysia retire on 30042020. Lee the court ruled that there could be a corporate tax essentially saying the structure of business was a justifiably. The engagement letter should specify whether the CPA engaged to prepare a tax return also will file it for the client or whether the client will be responsible even though in most cases the client will be required to sign the form before it is filed.

Prior to the date of this letter all required distributions have been made to you in accordance with the terms of the Trust. I have already made an advance payment of my income tax for assessment year 2015-16 the copy of which has been enclosed with this letter. When Kovel is not used correctly it jeopardizes the attorney-client privilege.

Use Form 4506-T if you need a letter for older tax years. This tax season parents and families will need to pay special attention to their filing in order to reconcile the child tax credit amounts they may or may not have received throughout 2021The IRS has sent out a letter to families Letter 6419 detailing the amount of money taxpayers received last year in terms of advance payments. After 90 days its time to turn the invoice over to a collection agency.

It doesnt indicate whether you are required to file a return for that year. Hi clients name I hope everythings great on your end. 15 2021 tax professionals are able to order up to 30 Transcript Delivery System TDS transcripts per client through the Practitioner Priority Service line.

This is an increase from the previous 10 transcripts per client limit. For example if a shareholder purchased 100 in stock no more than 100 can be lost. You could also use letters in front of a number which might indicate a specific client.

State the amount of money retained in Form CP21 CP22A. This means both your companys information and the details of. The longer a client doesnt pay an invoice the less likely theyll pay at all.

The taxing authority has prescribed procedures in place for an attest client to permit a member to sign and file a tax return on behalf of the attest client for example Forms 8879 or 8453 and such procedures meet at the minimum standards for electronic return originators and officers outlined in Form 8879 or. The example below focuses on some of the more important items. A protest letter should contain headings to address each of the items required as listed above.

On LHDNM Client Charter. A disclosure of tax return information is the act of making tax return information known to any person in any manner whatever and use of tax return information is any circumstance in which a tax return preparer refers to or relies upon tax return information as the basis to take or permit an action Treasury Regulations sections. Preparation Compilation and Review Standards Find standards for performing preparation compilation and review engagements of a nonpublic entity.

Therefore I request you to please go through these documents and drop the demand which has been wrongly raised by passing a rectification order for the same. It is extremely important that you have correct contact number and email submitted with Income Tax DepartmentIf you need to have your contact details or email changed then for that you need to write a formal letter informing the department to change these details for you. A transcript isnt a photocopy of your return.

This letter is available after June 15 for the current tax year or anytime for the prior three tax years using Get Transcript Online or Form 4506-T. For example in a compliance engagement someone must agree to actually file the completed return. Add company name and information.

On the other hand a corporation Corp or a limited liability company LLC may hold assets such as real estate cars or boats. Employers are required to comply with the Tax Clearance Letter issued by IRBM. The guidance and rules for all AICPA members for example those in public practice industry government and education to follow in regards to the performance of their professional responsibilities.

WASHINGTON The Internal Revenue Service today announced that effective Nov. A Kovel letter is used in very-limited situations in which an attorney wants to try to extend the attorney-client privilege on matters involving highly-complex accountingtax situations only. Invoice XXXX Payment Reminder.

Michael Smith will leave Malaysia on 30042020. For Tax Year 2008 Form 1040 I request that all failed to pay and failure to file penalties be abated based on the foregoing reasons. Some are essential to make our site work.

IR-2021-226 November 16 2021. A Kovel Letter is not statutory law and can be rejected by courts. The purpose of this letter is to provide information regarding the settlement and dissolution of the Trust.

Tax Specialist Cover Letter Example Kickresume

Sample Client Letter Tax Advice Fill And Sign Printable Template Online Us Legal Forms

Income Tax Preparer Cover Letter Example Kickresume

24 Printable Reminder Email Sample To Client Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

Tax Preparer Cover Letter Examples Finance Livecareer

Tax Preparer Cover Letter Sample Skills Writing Guide

Comments

Post a Comment